October 2020 Consumer Habits Study

Two-thirds of 2020 has been spent trying to survive a pandemic. We are still trying to figure out what works best, and each day we are continuing a path of unknown. Unknown how long the pandemic will continue, unknown how long we will operate with restrictions, unknown how our customers will behave. But as brewery owners and entrepreneurs, we do not give up.

As the weather begins to get colder, it’s even more important that you are maximizing every customers' on-premise visit. Many of you have been fortunate enough to have your communities come behind you in overwhelming numbers to support you thus far. We cannot take their purchases for granted and need to continue running our best businesses possible to beat the cold.

I conducted a study to get a better gauge of current consumer attitudes and spending habits. This research includes 2128 unique submissions. 51.6% of respondents identified as male, 47% as female, 0.8% as non-binary, and 0.6% preferred not to say. The average age of respondent is 40.1 years old. All data was collected October 13 to 20, 2020.

Here is a breakdown of the geographic location of respondents. We define each region as the following:

Midwest: OH, MI, IN, WI, IL, MN, IA, MO, ND, SD, NE, KS

Northeast: ME, NH, VT, MA, RI, CT, NY, NJ, PA

South: DE, MD, VA, WV, KY, NC, SC, TN, GA, FL, AL, MS, AR, LA, TX, OK, DC

West: MT, ID, WY, CO, NM, AZ, UT, NV, CA, OR, WA, AK, HI

We first asked respondents, “How often are your visiting breweries compared to before COVID-19?” Nearly two-thirds are visiting breweries less frequently compared to before the start of the pandemic.

With regard to their visits, 58% stated that more planning is going into their brewery visit compared to before COVID-19.

When asked to choose the 3 most important aspects of planning a brewery visit, slightly over 62% of respondents included “the brewery’s current beer menu.” This was closely followed by “how well the brewery is showing adherence with COVID-19 protocol on social media” then “an outdoor space.” According to the Bart Watson’s insight and analysis from “Q3 Survey Shows Improvement, But Sales Still Depressed,” the average brewer estimates that 64% of their onsite sales occurred outdoors. The importance of an outdoor space is validated in this study as being included as one of the top 3 criteria.

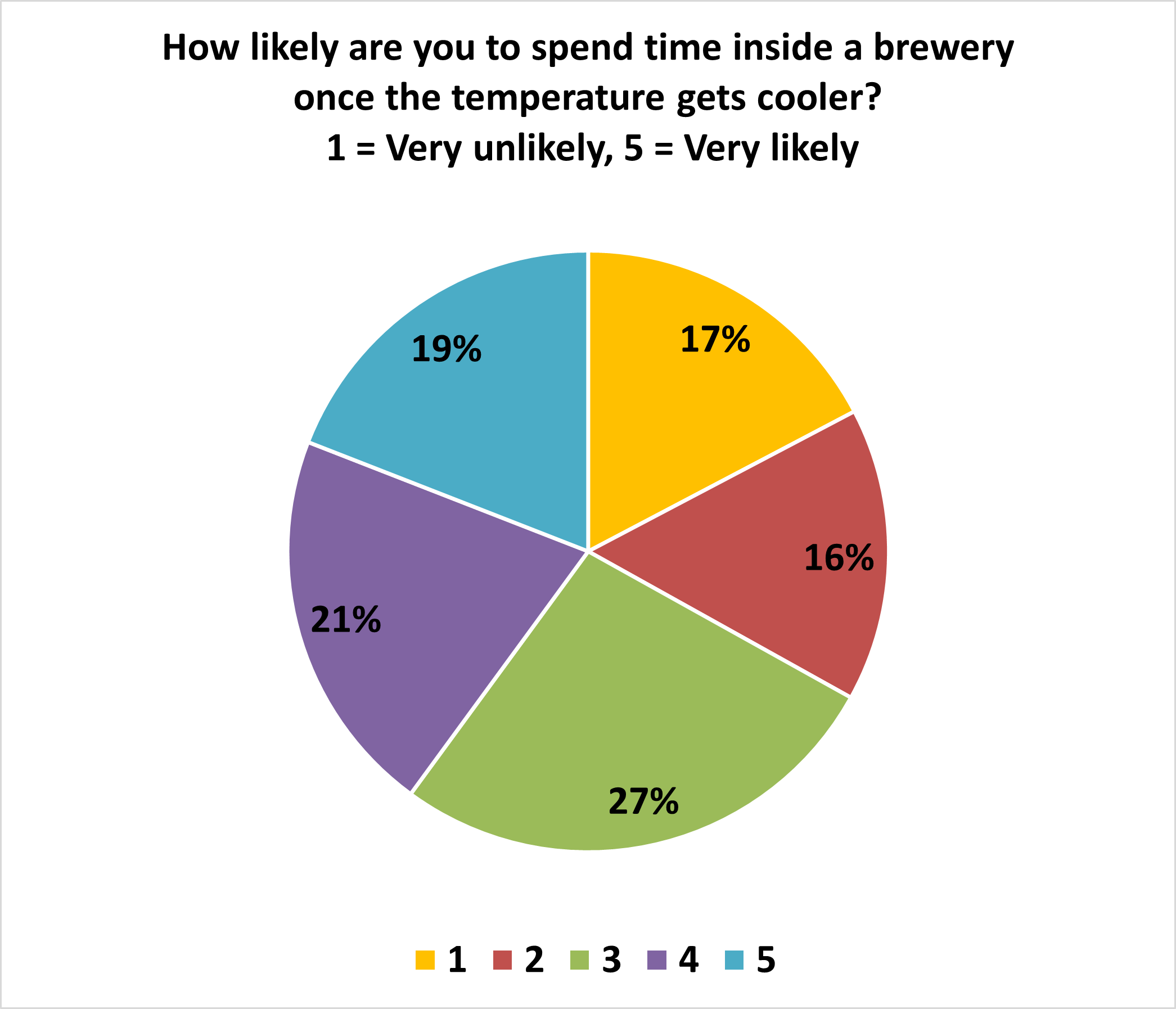

Despite the importance of an outdoor space, we are currently seeing nearly half of brewery goers willing to enjoy a beer indoors. Once the temperature gets cooler, 33% of respondents say that they will not enjoy a beer indoors, while nearly 40% state that they will enjoy a beer indoors. 27% remain in the middle.

Nationwide, 32% of respondents state that they will visit breweries less frequently once the temperature gets cooler. Nearly half of those surveyed plan to visit breweries at the same frequency. However, this data gets quite interesting when we break it down by region. 44% of guests in the Northeast plan to visit breweries less frequently. 38% of guests in the Midwest plan to visit less frequently. 28% of guests in the West plan to visit less frequently. 21% of guests in the South plan to visit less frequently.

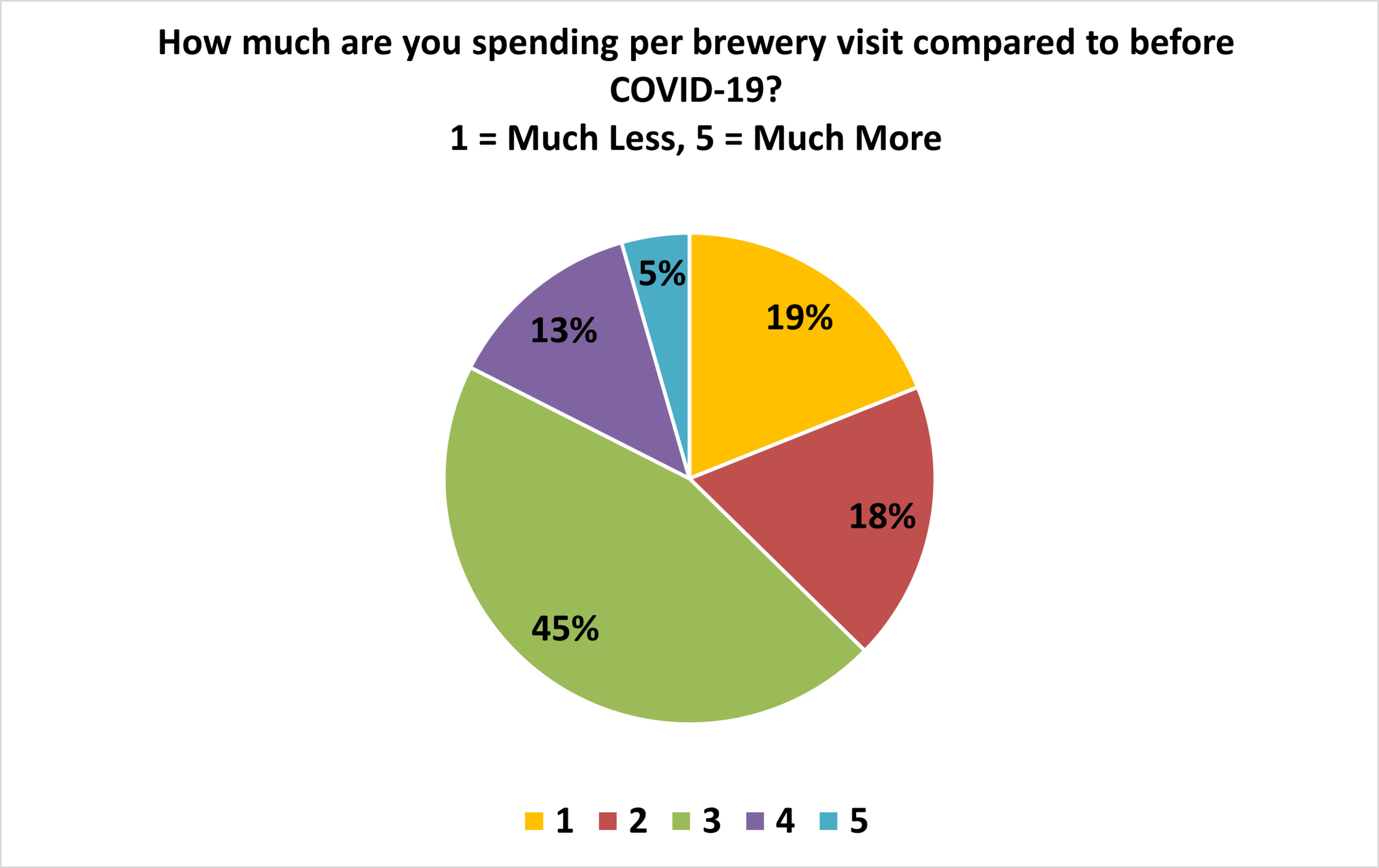

With guests visiting breweries less, we now look at how much guests are spending when they do visit. On a positive note, 63% of those surveyed are spending equal to or more than they were compared to before COVID-19.

What does all of this mean? Brewery visits are becoming more intentional. The majority of brewery goers aren’t visiting at the frequency they were pre-COVID and these numbers are only going to drop as the temperature continues to get colder. It is important that we safely, maximize each brewery visit, continue to promote and encourage beer to go, and do everything we can to remain fresh in our guests’ minds.